Buying a home isn’t just a numbers game—it’s a people game. And the most important person in the process is you. How you think, decide, manage stress, and communicate has a direct impact on the experience and the outcome. That’s why understanding your DiSC profile—Dominance (D), Influence (I), Steadiness (S), or Conscientiousness (C)—can be a game-changer.

Buying a home isn’t just a numbers game—it’s a people game. And the most important person in the process is you. How you think, decide, manage stress, and communicate has a direct impact on the experience and the outcome. That’s why understanding your DiSC profile—Dominance (D), Influence (I), Steadiness (S), or Conscientiousness (C)—can be a game-changer.

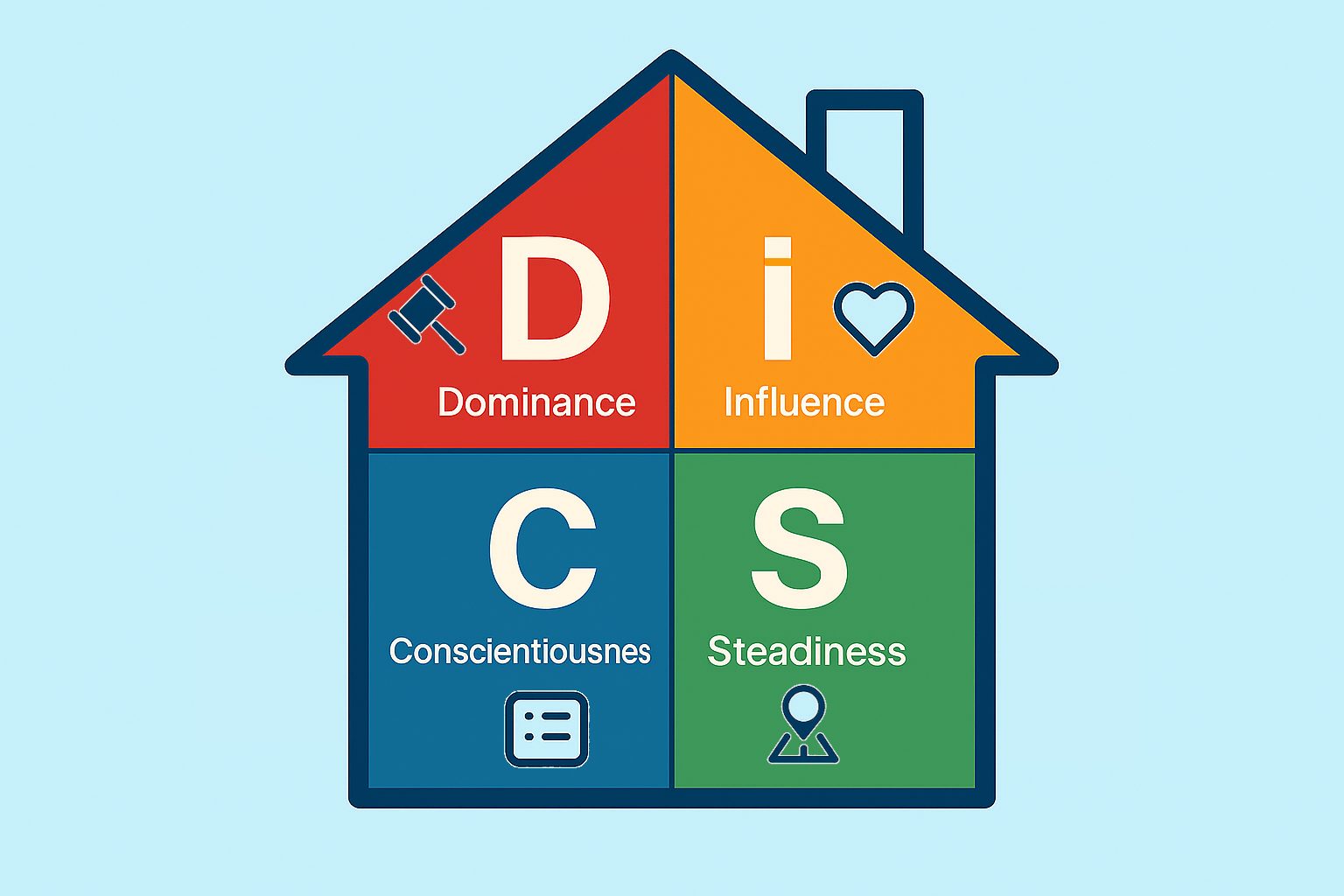

What is DiSC (and why it matters for buyers)?

DiSC is a simple behavioral framework that explains how people prefer to communicate, decide, handle risk, and deal with conflict. The framework identifies four different profiles that describe the preferred or natural responses of different individuals to the people and situations they find themselves in:

- D (Dominance): Direct, decisive, competitive, results-first.

- I (Influence): Social, optimistic, enthusiastic, people-first.

- S (Steadiness): Patient, consistent, supportive, stability-first.

- C (Conscientiousness): Analytical, accurate, systematic, detail-first.

In real estate, these preferences influence:

- Speed vs. certainty: Do you move fast or wait for complete information?

- Negotiation style: Do you anchor hard, relationship-build, or analyze your way there?

- Risk tolerance: Do bidding wars excite or overwhelm you?

- Stress response: Do you take charge, seek connection, seek stability, or go deep into data?

Markets behave differently—and so do you

Your experience also depends on the market context. Are we in a buyer’s market or a seller’s market? Or maybe even a balanced market. Here are some of the characteristics of each type of market:

- Buyer’s Market: More inventory, longer days on market, more negotiation leverage.

- Seller’s Market: Limited inventory, faster pace, multiple offers, higher competition.

- Balanced Market: Moderate inventory and days on market; neither side has a strong advantage.

Different markets amplify different strengths and expose different blind spots—especially when your personality is under pressure.

How to use DiSC during your home search

1) Identify your primary and secondary styles.

Perhaps you have already had a DiSC profile generated, for a job or in school. If not, there are some tools like this one that can help you gain insight on your primary DiSC style. Most people are a blend of styles. For example, a D/C will drive fast but care deeply about data. An I/S values both connection and harmony.

2) Pre-commit to decision rules.

Before you tour, agree on the guardrails you’ll use to prevent stress-based decisions:

- Criteria threshold: “We buy if a home meets ≥80% of our must-haves.”

- Budget cap: “We cap total out-of-pocket at $X and monthly at $Y.”

- Time box: “We decide within 24–48 hours after a strong contender.”

- Walk-away conditions: “Deal dies if inspection >$Z repairs or appraisal gap >$W.”

3) Assemble your support system.

Match your style with complementary strengths:

- D: Work with a detail-strong agent and inspector who won’t skip steps.

- I: Add a numbers-forward mortgage pro and a realistic friend as a sounding board.

- S: Choose a patient, proactive agent who will prep you for fast decisions.

- C: Use templates and deadlines so data doesn’t slow you down.

4) Design your offer process ahead of time.

Create a standard offer checklist so you’re calm when you need to move:

- Financing type + pre-approval ready

- Earnest money, contingencies, inspection strategy

- Appraisal gap coverage (if any), timeline commitments

- “If-this-then-that” rules for counteroffers

Stress signals & self-coaching prompts

- D Stress Signals: Impatience, pushing too hard, skipping details.

- Prompt: “What detail am I ignoring that could cost me later?”

- I Stress Signals: Impulsivity, FOMO, people-pleasing.

- Prompt: “Does this fit the budget and 80% of must-haves?”

- S Stress Signals: Decision delays, discomfort with change.

- Prompt: “What would be ‘safe enough’ to move forward today?”

- C Stress Signals: Analysis paralysis, over-focusing on flaws.

- Prompt: “Is this good enough? What’s the cost of waiting?”

A simple worksheet to align your style with your strategy

Must-Haves (Top 5):

- __________ 2) __________ 3) __________ 4) __________ 5) __________

Nice-to-Haves (Top 5):

- __________ 2) __________ 3) __________ 4) __________ 5) __________

Budget Rules:

- Max price: $_____

- Monthly target: $_____

- Cash to close target: $_____

Decision Rules:

- Criteria threshold: ___%

- Research time box: ___ hours

- Walk-away conditions: _____________________________

Final thoughts

Your DiSC profile doesn’t limit you—it equips you. When you understand how you naturally approach decisions, you can design a buying process that plays to your strengths and protects your blind spots.

As a strong C myself, I focus on process and data to help my clients make the home-buying process as stress-free as possible. I am deeply aware of just how challenging the past 4 years (2021-2024) have been for S and C buyers. Take heart! Things are changing. It is getting less competitive and you will have more time to analyse and process the housing options available, and choose a home with confidence.

In the next posts, we’ll dive into D, I, S, and C profiles with market-specific strategies for buyer’s, seller’s, and balanced markets—plus scripts, checklists, and “smart moves” you can copy/paste into your plan.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link